Pipe & CapChase - Securitize SaaS Contracts

Just-in-time-financing

I’ve always been told that sharing is caring. But what about founders of startups when they need cash? Should they have to share as often or as significantly as they do when they dilute their shareholder base, all in the name of raising money?

Startups burn a ton of cash. Massive sales bonuses, customer acquisition costs, investment in product development, and the growth at any cost mindset causes startups to torch their cash reserves very quickly. For startups that are spending cash in order to scale, access to working capital is a top priority. Without it, they really can’t grow and reinvest in themselves.

So how do startups get more cash? Well, there are 4 primary options:

Raise money via equity

What seems to be the gold standard for venture liquidity needs, equity fundraising can satisfy cash necessities while also giving startups a stamp of approval and support from proven venture capitalists. However, equity issuance substantially dilutes the ownership of the founders. If you give away 10+% of your ownership funding round after funding round, you are likely to be a minority shareholder pretty soon. Should the ownership of the founders and employees be diluted everytime the company has a working capital need?

Raise money via debt

Going through the loan process is a massive pain in the butt and one that I cannot understate. It takes time, lenders conduct lengthy due diligence, there are costly legal fees and there is a waiting period to access the cash. In addition, technology companies in particular are difficult for lenders to understand due to their business models and many years of unprofitability! More importantly, however, the debt itself is extremely limiting between high-interest rates, vastly restrictive covenants and dilutive warrants, and inflexible payment schedules. Very few startups would want to take on debt as they would be unable to guarantee consistent financial performance or service interest obligations - it is extremely risky.

Offer discounts on contracts for cash upfront

SaaS customers want to pay for the software they use on a monthly basis. It makes sense. But SaaS providers want the full value of their customers’ contracts upfront. To get access to this cash early, startups will resort to offering massive discounts to their customers to pay the entirety of their contract upfront. This results in a sizeable portion of the original contract value being left on the table.

Other financing alternatives

Factor your accounts receivables

When you deliver a product to your client, you send them an invoice. You can “factor” your accounts receivables balance by “selling” this invoice to a factoring company. This company will give you a cash advance on your invoice and use the invoice as collateral. Although this is helpful, it only helps with short-term funding solutions, as it is a discrete way to access capital from your receivable line. As a result, factoring does not provide larger, annual liquidity support. Additionally, software companies bill upfront and receive cash which is recognized as deferred revenue, not receivables, thus these companies are unlikely to have meaningful accounts receivable balances. Thus software companies can not receive significant capital from factoring receivables lines.

Revenue-based financing

Simply put, revenue-based financing is capital provided to a company in exchange for a fixed percentage of revenues, up until a predetermined multiple of the principal is reached. This is pretty destructive in terms of working capital needs based on the performance of the company but is used primarily by e-commerce companies.

How can we try to minimize the pain points of these different methodologies to provide liquidity to startups with more speed, convenience, and with fewer strings attached?

Two companies: Capchase & Pipe, are tackling different solutions to this problem by providing what has been called “just-in-time financing”, essentially what I see as a blend of factoring and discounts.

Pipe

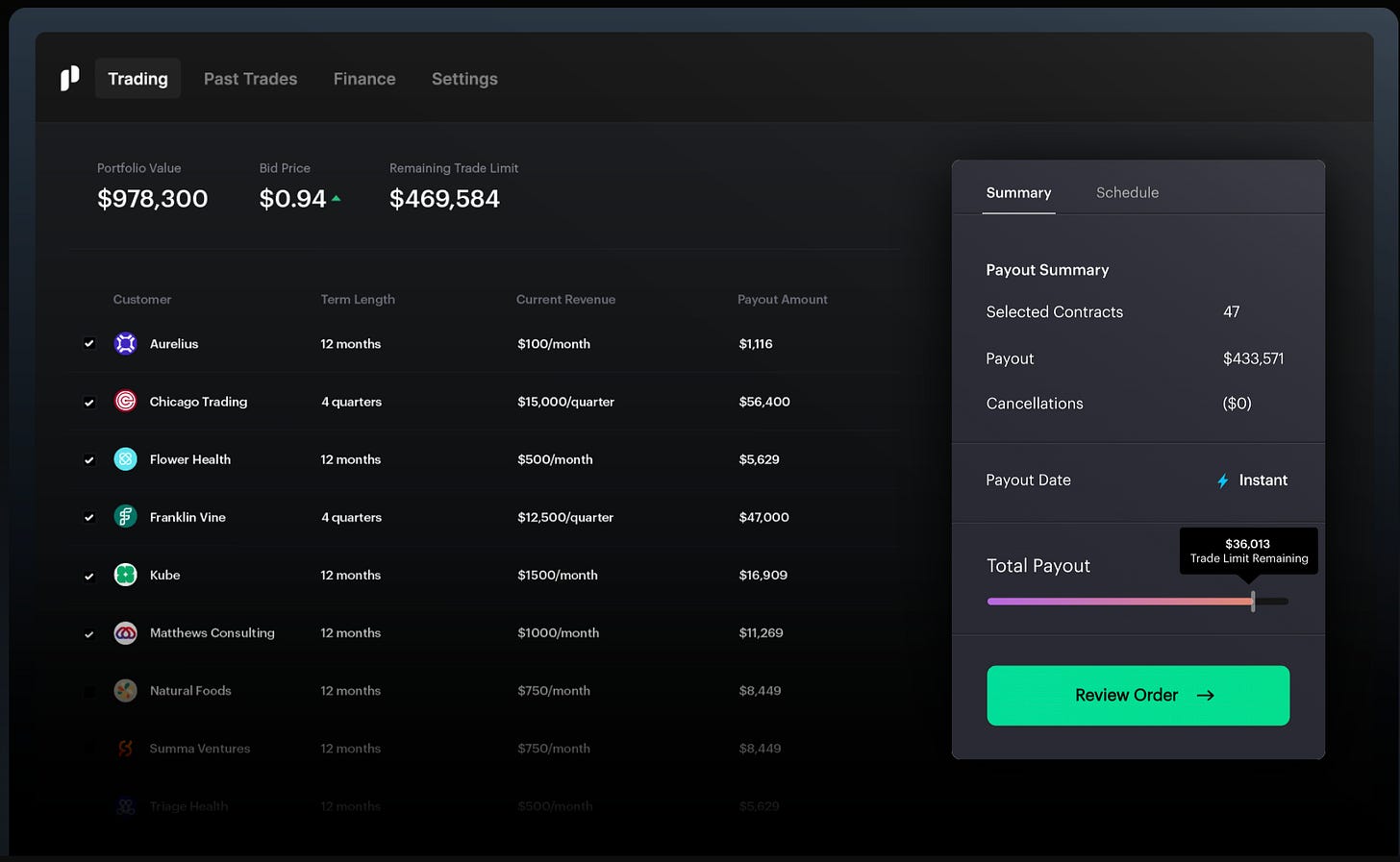

Pipe is a marketplace trading platform that connects cash-hungry startups (that have customer contracts) with institutional investors who want to invest in these customer contracts. Pipe was started to help remedy the equity dilution problem and debt difficulty problem. They raised $250MM at a $2Bn valuation back in March of 2021.

The company enables SaaS companies to trade their customer contracts for cash, worth approximately 90-95% of their annual contract value. Pipe does this by connecting companies who need instant access to cash with institutional investors that pay discounted rates for the value of those contracts. Pipe has given companies the ability to securitize their recurring revenue streams and make them fully liquid/tradeable.

After completing the signup on the Pipe platform, Pipe assesses the company’s key metrics by integrating with its accounting, payment processing, and banking systems. It then rates the performance of the business and qualifies the company for a trading limit based on KPIs and financial metrics. Once approved, customer contracts are available and ready on the platform to be traded. The value of your company’s contracts is based on how much investors are willing to pay for your recurring revenues, which are driven by the health and size of your business.

Pipe offers trading limits from $50,000 for smaller companies to over $100 million for late-stage companies. It is important to note, Pipe has no cost of capital as they do not lend, they simply connect. Institutional investors bid against one another for the right to securitized customer contracts. As a result, Pipe charges both parties of the transaction a fixed trading fee of up to 1%, depending on trade volume. Once a contract is traded to an investor, cash will be deposited into your account on the same trading day. And,

As your customers pay you each month, Pipe automatically withdraws the payments and distributes the funds to the investors. We’ll notify you of each transaction through the Pipe platform and by email. Your payment schedule matches your revenues (e.g., if you’ve traded quarterly revenue streams your repayment schedule will also be quarterly.)

- Pipe

If one of your customers churns you can return the up-front capital you received on a prorated basis for the churned period or you can swap another contract to replace the churned one.

Founders can save weeks or months pitching their company and meeting with potential investors, instead getting immediate access to capital at a cheaper cost to them than raising debt or equity. Since it launched in June 2020, 4,000 companies have signed up and 1,000 of those have signed up since the most recent fundraise in March 2021. Their growth has catapulted the company into the spotlight. Pipe’s tradable annual recurring revenue (ARR) is in excess of $1 billion and rapidly approaching $2 billion. As of late, the platform sees tens of millions of dollars being traded every month.

Capchase

Where Pipe is a marketplace connecting startups with investors willing to “buy” the revenue associated with a contract at a discount, Capchase directly advances the deferred revenue associated with customer contracts. They don’t consider themselves a lender (because there is no interest rate or maturity date) or a factorer (because they are not buying the contract) per a podcast (at 12:25).

Capchase raised $80MM in Series B funding as of March 10, 2022. Capchase offers a deferred revenue advance to startups that needs cash at a discount to the full contract value of one of their customers, and then collects the full value of that customer’s contract as that customer makes their payments.

For example, Company A has a customer that has an annual contract value of $120, meaning the customer would make 12 payments of $10 over the course of the year.

Company A, in need of cash, would sync their financial data with Capchase, and Capchase offers Company A $100, a $20 discount to the full value of the contract.

Company A accepts the lump sum of $100 and Capchase would then collect (from Company A) the full value of the customer contract ($120) over the course of its monthly payments. The amount of the discount Capchase will offer is obviously dependent on the startup, their financial and operational metrics, and more.

According to a video interview with CEO and co-founder of Capchase, Miguel Fernandez, Capchase shows up on the balance sheet as a short-term liability / deferred revenue advance, and Capchase is not secured in the capital structure of the entity of the company that is being lent to. This is actually a plus in the eyes of VC as they will be paid out before Capchase is.

Matt Snow puts it very clearly in his Medium article:

Utilizing this solution, SaaS companies don’t need to give [as steep] discounts and are able to erase the friction associated with negotiating payment terms. They also get the cash upfront to reinvest it in growth and extend their runway. Overall, by using Capchase, SaaS companies can sell software at a higher price, more often, and for longer than they would under the old way of doing business.

Since its launch, Capchase has helped ~3,000 companies across the U.S. and Europe, making >$2 Bn in funding available to founders and extending runways by over 5,000 months. In addition to these milestones and the growth of its revenue-financing product, Capchase Grow, Capchase has quickly launched two additional products: Capchase Extend, a buy now pay later (BNPL) solution for businesses, and Capchase Earn, a high-yield account that pays a competitive return on companies' idle cash (such as VC funds), helping to further reduce their overall cost of capital. Another product they just rolled out is CapScore™, a proprietary data platform that evaluates data points (subscription rates, growth, cash on hand, and more) to determine a company’s ability to repay a loan.

What’s the catch?

Well for starters, Pipe and Capchase have two different business models.

Pipe is a marketplace that connects supply and demand: startups that need capital with investors that are willing to factor their contracts. And typically connecting supply and demand is lower risk than actually having skin in the game as Capchase does. But, a risk that is easy to identify is investor appetite (on the demand side of the Pipe marketplace).

How do the returns of purchasing a discounted customer contract compare to alternative investment types?

Are investors willing to purchase the rights to a customer contract from a higher-risk startup?

How many investors are sophisticated enough to independently diligence technology startups and are willing to make an investment. Are investors willing to not only underwrite the customer contract (and its terms) but also the company it purchased it from? Does the investor get full access to the entire suite of financial and operating metrics associated with the startup?

Can investors diligence and research the terms of each customer contract that is listed on the Pipe platform?

How does the value of these customer contracts change in times of market turmoil (like now) / or bull markets?

Are startups and in particular, founders willing to share data and customer contracts with interested investors?

In addition to appetite is the discussion of transaction volume. Pipe only makes money if demand and supply-side entities are transacting on the platform. If investors are not interested in making these investments for the reasons listed above and more, Pipe doesn’t make money either.

Capchase on the other hand is pretty much a lender / factorer without the interest rate. With that, comes tremendous capital intensity needs. It needs to be able to underwrite large “loans” to companies in exchange for their customer contracts that will be paid out over a static and inflexible period of time. There are dollars at risk here but at least Capchase gets to conduct their own diligence and make offers for customer contracts at their discretion. It does not have to wait around for investor interest / a market and can instead be flexible.

Capchase likely takes the loans it makes on recurring revenue contracts of different risk profiles, bundles and collateralizes them, and then resells them to investors. If this sounds vaguely familiar, that’s because it is; it’s the same sort of concept that when not kept in check, caused the 2007/08 financial crisis.

The factoring market is massive. Everything from loans on homes, cars, credit cards, and far, far more are all factored. In 2020, Grand View Research estimated the global factoring market to be $3.2 Trillion and by 2028 it is expected to be $5.9 Trillion. This is an enormous market with a steady growth rate, so Capchase deferred revenue advances and Pipe connecting startups with pseudo-factorers is a play into a massive and growing space.

I have seen firsthand some of my friends in the startup ecosystem go through the pain associated with equity raises. At the same time, I have been a part of teams that have provided guidance to founders dreadfully raising money via equity and debt during my time at Morgan Stanley. Pipe and Capchase are two unique and exciting businesses that increase accessibility to “just-in-time financing” and reduce the pain points associated with other fundraising measures. They may very well help change how companies get cash in the future!

Let’s not talk about the Duke-UNC game.

Never have I ever seen a vibe killed as quickly as it was in the last 2 minutes of the game Saturday night. My heart was pounding, everyone was jumping, cheering, and yelling. Was truly a one-of-a-kind matchup. The bar full of Duke people went dead silent. Was glad to see Kansas pull out the dub (and an astounding comeback at that) to avenge us Monday night.

In better news, I mastered one of my all-time favorite pasta dishes as a kid

Linguine Vongole - the taste of clams, garlic, olive oil, and chili flakes is just too goddang good.

Finished off my weekend with Shrek 4 and Avengers Age of Ultron with my friends, lots of food, and plenty of candy. Big sour candy guy, praying I don’t land a cavity….

GW